Bizsquare is your #1 result-focused business loan consultancy firm that gets you the loan approval you desire

Working Capital Loan (WCL)

With the cease of TBL, working capital loan (WCL) works as the alternative to help company expand and overcome cashflow needs. Working Capital loan is also supported by Enterprise Singapore by co-share 50% of the risk. Singapore businesses can get SME loan of up to $500k in 2025.

PROPERTY LOAN

Save money on your monthly installments through mortgage plans with low and competitive interest rates and by refinancing to plans with lower interest rates.

TRADE FACILITIES

Credit insurance scheme, premiums partially supported by Government. For short-term trade finance needs such as inventory/ stock financing.

PRIVATE FINANCING

Each private financing option individually tailored criteria to your needs so you might find it much more flexible compared to traditional bank lending.

YOUR BUSINESS SUCCESS IS WHAT WE MATTER. HOWEVER, WE DON’T SIMPLY SERVE ANYONE.

Only if you are a BUSINESS OWNER who will believe in expertise and will truly entrust the professionals to bring your business to a long-term success, then you are the correct audience that we can help.

Most of the clients come to us when:

1. Their business need more cashflow to survive but do not have a solution.

2. The business were awarded a project, but unable to fund the project.

3. Does not know how to obtain a business loan in Singapore from the banks. (Facing rejection from banks)

4. Worry what they do with their loan will affect their credit record and need advice from an expert.

5. Unsure if it is worth it to obtain a bank loan for their business and wish to seek advice.

6. Confused on their business strategy when they are fund-raising and wish to consult an expert.

If you are a business owner who faces the above issue and feeling confused and frustrated. Thus, causing you not able to focus on your operations.

THEN BIZSQUARE IS THE CORRECT COMPANY FOR YOU - BUSINESS LOAN SINGAPORE

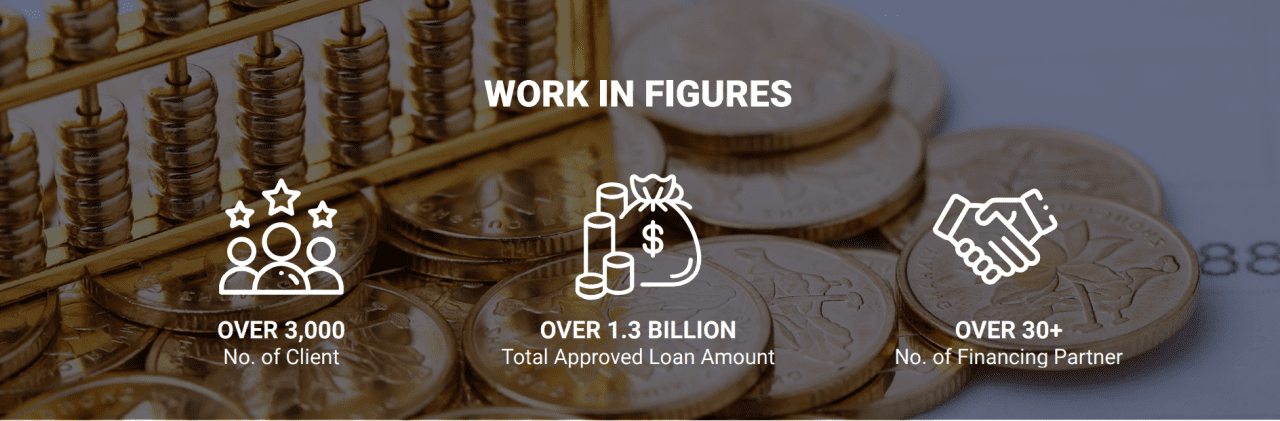

Simply stop the stress and frustration by working with a professional business loan consultancy company who have helped over 3,000 business owners in the last 12 years to obtain the business loan in Singapore that they couldn’t achieve themselves.

Many of them have also listened to Bizsquare’s advice and have since grown their business to new heights.

We take your business to a whole new level with our conversion-focused strategies.

Bizsquare started from 2013, and has applied over 10,000 loan applications for over 3,000 business owners over the last 12 years. After experiencing so much, we understand exactly what it takes for you to get there.

We are the EXPERTS, we will use what has proven to convert and instead of you telling us what to do…

We will tell you how to secure the best business loan in Singapore for your needs.

Simply stop the stress and frustration by working with a professional business loan consultancy company who have helped over 3,000 business owners in the last 8 years to obtain the business loan Singapore that they couldn’t achieve themselves.

Many of them have also listened to Bizsquare’s advice and have since grown their business to new heights.

We take your business to a whole new level with our conversion-focused strategies.

Bizsquare started from 2013, and have applied over 10,000 loans applications for over 3,000 business owners over the last 8 years. After experiencing so much, we understand exactly what it takes for you to get there.

We are the EXPERTS, we will use what has proven to convert and instead of you telling us what to do…

We will tell you what to do to secure the best business loan in Singapore for your needs.

SINGAPORE LOAN INFO

Don't Just Take Our Word For it... See What Our Clients Have to Say About Us

What Our Customers Say

Posted onTrustindex verifies that the original source of the review is Google. Approached Melvin and team a few months back and they were very professional and responsive in helping us to improve our business. Highly recommended! 👍🏻Posted onTrustindex verifies that the original source of the review is Google. Professional, responsive and sincere team. Would definitely recommend their services to any SMEs seeking for business loans or financial advice!Posted onTrustindex verifies that the original source of the review is Google. Great financial service, professional on giving advice and valuable assistance!Posted onTrustindex verifies that the original source of the review is Google. It is a pleasure working with Melvin and Jamie. They are very helpful and supportive so I can develop myself professionally. They also give me the freedom to share my ideas and opinions 👍🏻👍🏻Posted onTrustindex verifies that the original source of the review is Google. The team is very professional in handling and helping me to get my loan. Will definitely approach them again. Is a great opportunity and pleasure to work with them.Posted onTrustindex verifies that the original source of the review is Google. One of the most professional companies I've ever worked with! Highly recommended and would definitely approach them again. Very blessed to have the opportunity to work with them!Posted onTrustindex verifies that the original source of the review is Google. Melvin and team are very professional in handling my company's finance matters. They raised money for my company and advise me how i should be allocating my funds to help in the growth. Even during current situation, our company can do well. I am blessed to have known them.Posted onTrustindex verifies that the original source of the review is Google. I knew Bizsquare through social media and have worked with them since Aug 2020. Melvin has assisted my business in loan financing and business strategy and honestly, without his help, I don't think my business will be able to survive through COVID. I highly recommend Bizsquare to fellow business owners!Posted onTrustindex verifies that the original source of the review is Google. Bizsquare is providing us with professional advisory to help us grow our business. Managed to obtain business loans from banks and advice us how to leverage on the money to scale our business. Exceeded my expectations!Posted onTrustindex verifies that the original source of the review is Google. I saw an ad on Facebook and I put my name and number. I received an email from a Bizsquare sales manager on the next day. I went to Bizsquare office, met sales manager Mr.Desmond and his boss Mr.Melvin. They understood all my requirements clearly and gave a correct guidance on the loan packages and grant in the market. Bizsquare managed to get a few business loan for my company. It was a hassle free experience. I will highly recommend Bizsquare and the team for prompt responses, professional behaviour, quality service and for a great consultancyLoad more

OUR MISSION

Bizsquare help serious business owners who wish to grow their business in a faster and hassle-free way, soving their cashflow issues and they never have to worry about their cashflow ever again.

OUR FEATURES

MARKET EXPERIENCE

With our experience, we have successfully helped over 3,000 clients get funding and support amount.

INTEREST RATE

We compare offers from lenders to help you find competitive interest rates for any business loan and SME loans in Singapore.

APPROVAL RATE

We tailor each submission to lender criteria to meet what lenders want to see, increasing your business financing approval rates

FAST PROCESS

Our processing time is short and we handle most of the paperwork for you because we know what our financing partners are looking for

LOAN AMOUNT

Successfully helped companies who work with us, to get higher funding than the usual amount.

BUSINESS ADVISORY

We are a certified Practicing Management Consultant who provide business advisory services to businesses and start-ups on how to run their businesses better.

What Differentiates Us?

Our founder Background

Goverment recognized management Consultant

Our network is Strong

We can cross refer deals to our clients

Professional Affiliates

We have Strong Contacts with professional to help raise funds

Our Membership

Our membership discounts for Bizsquare customers

OUR PURPOSE

Here is a video of our CEO Melvin Ho Sharing on why he started Bizsquare and his purpose.

OUR FINANCING PARTNERS

SME BUSINESS LOAN SINGAPORE FAQ

The funding amount differs depending on the type of singapore business loan you wish to apply, between banks and also dependent on your company’s profits.

Yes, definitely but there are very limited options for new start-ups. Most of the banks do not provide start-up business loan singapore for newly registered companies therefore it would be a struggle to obtain bank financing during the initial phase. However, we will try our best to reach out to suitable financial institutions that will help you.

If you are not qualified for our business loan singapore, we will ensure that we let you know all the information you need to improve your financial situation and your business. Afterwards, you can put in another application at a later date with better chance of qualifying. Many businesses opt for loan due to urgent needs for project funding. When an application has been declined, the business may not be eligible to apply to the same lender for as long three to six months.

Here’s some of the potential reasons why an application might get rejected:

- Singapore business’ owner credit profile

- Not understanding the financials that was submitted

- Applying to the wrong bank for funding

- The loan limit that is applying

Once you apply for a loan, the financial institution will look up your personal credit report. Your credit report will then be taken into account when your application is being surfaced. If you have a low credit rating, there’s a higher chance that your business loan will be negatively affected by it. However, Bizsquare can help you to identify the various banks and other financial institutions that have credit criteria that is suitable for your business profile, so that you can maximize your chances of approval for a business loan.

The average interest rate currently ranges from 2.5% – 7.5% effectively per annum, depending on the type of business loan you are applying for and the company’s credit profile.

Typically we will need:

- last 6 months of company bank statement

- Last 2 years of financial statement

- Last 2 years of notice of assessment

- NRIC of the guarantor

Depends on the volume of application at that point in time. Typically 2-4 weeks.