TRADE FINANCING IN SINGAPORE - Cashflow Solutions for Importers, Exporters & Trade-Intensive SMEs

Whether you are a wholesaler, distributor, or importer, trade finance could give you the cash you need to pay your suppliers. It also help to improve your cashflow but receiving earlier payment from your customer.

Check your eligibility now!

Leave us your details and we’ll be in touch to share details of the financing schemes available.

By submitting this form, you consent to being contacted so we can provide you more information, and that you agree to our Privacy Policy.

TRADE FINANCING IN SINGAPORE

Cashflow Solutions for Importers, Exporters & Trade-Intensive SMEs

Check your eligibility

Leave us your details and we’ll be in touch to share details of the financing schemes available.

By submitting this form, you consent to being contacted so we can provide you more information, and that you agree to our Privacy Policy.

BUSINESS TERM LOAN SINGAPORE

At Bizsquare, we enable businesses to eliminate cashflow gaps in trading cycles by offering tailored trade finance solutions. Whether you’re importing inventory, exporting goods, or managing complex logistics, our structured facilities help relieve payment risks and improve liquidity—so you can operate with confidence and scale your trade operations efficiently.

At Bizsquare, we enable businesses to eliminate cashflow gaps in trading cycles by offering tailored trade finance solutions. Whether you’re importing inventory, exporting goods, or managing complex logistics, our structured facilities help relieve payment risks and improve liquidity—so you can operate with confidence and scale your trade operations efficiently.

WHAT IS TRADE FINANCING?

Trade financing is a specialized form of short-term working capital financing designed to close gaps between supplier payment and customer receipt. This includes invoice financing, accounts receivable discounting, letters of credit (LC), trust receipts (TR), and shipping guarantees. Rather than conventional business loans, trade finance facilities involve banks or financial intermediaries in your trade transactions to mitigate payment and delivery risks

If you’re a wholesaler, distributor, or importer, trade finance could give you the cash you need to pay your suppliers. There are various trade finance solutions, but what they have in common is they help you close the payment gap at the beginning of your sales cycle — so you can fulfill your customer orders without having to worry about your cashflow.

Trade financing is a form of working capital financing, comprise of invoice financing and supply chain financing. It is designed to give you the cashflow to buy inventory or stock from a supplier.

If you’re a wholesaler, distributor, or importer, trade finance could give you the cash you need to pay your suppliers. There are various trade finance solutions, but what they have in common is they help you close the payment gap at the beginning of your sales cycle — so you can fulfil your customer orders without having to worry about your cashflow.

Why Trade Financing Works for SMEs

Trade finance helps you reduce risk, speed up cashflow, and strengthen supplier trust. Through instruments like letters of credit, suppliers get payment assurance, while your business can defer cash outflow until sales are realized. It also enables aggressive order fulfillment—giving you room to negotiate better pricing with overseas suppliers.

Trade financing is different from conventional loans or credit application. General financing is used to manage solvency or liquidity, but trade financing singapore may not necessarily indicate a buyer’s lack of funds or liquidity. Instead, trade finance can be used to protect against international trade’s unique inherent risks, such as currency fluctuations, political instability, issues of non-payment, or the creditworthiness of one of the parties involved.

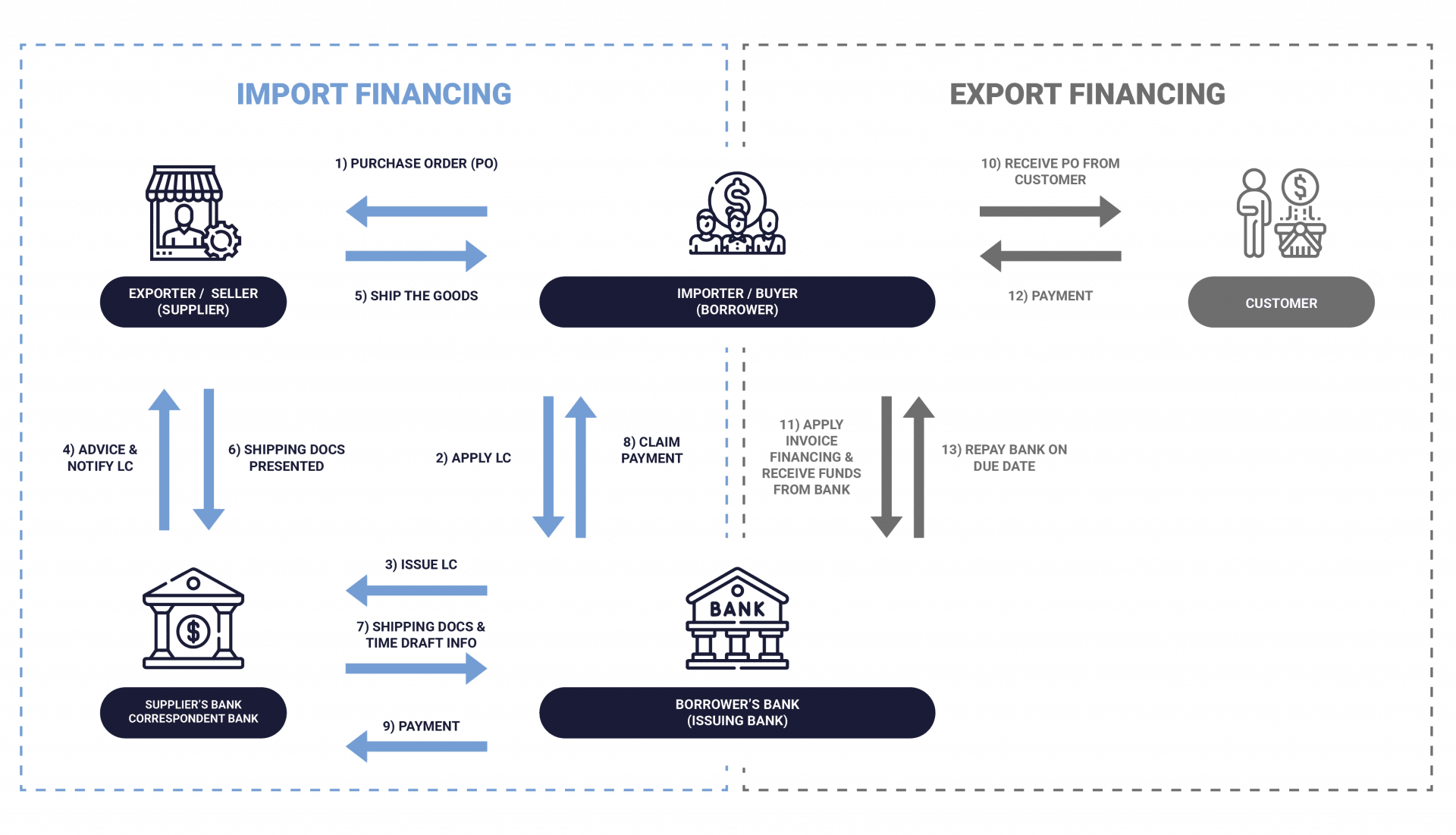

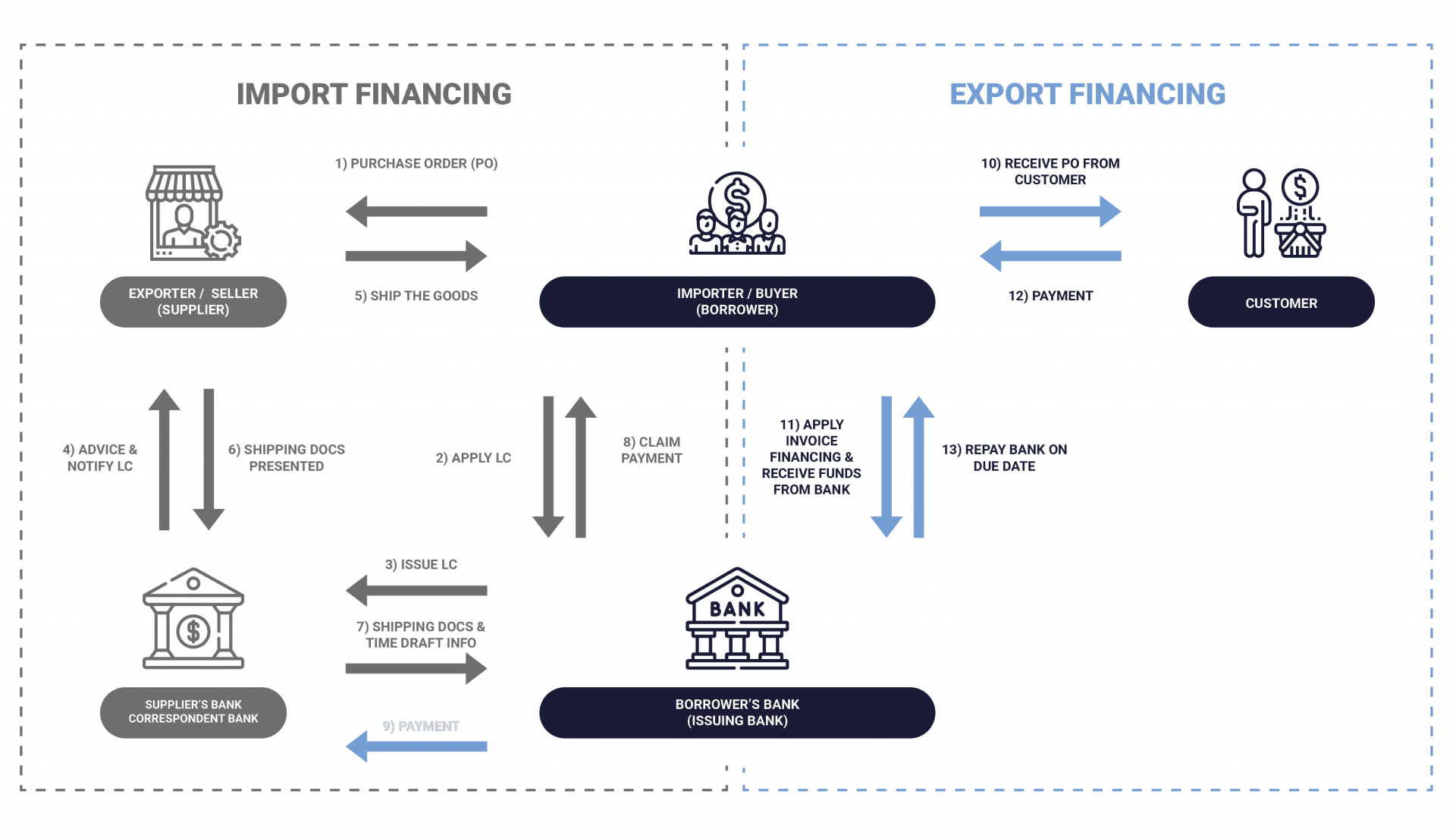

There are 2 main types of trade financing we do. Namely the Import and Export Financing.

The function of trade finance is to introduce a third-party to transactions to remove the payment risk and the supply risk. Trade finance provides the exporter with receivables or payments according to the agreement while the importer might be extended credit to fulfil the trade order.

Trade financing is different from conventional loans or credit application. General financing is used to manage solvency or liquidity, but trade financing singapore may not necessarily indicate a buyer’s lack of funds or liquidity. Instead, trade finance can be used to protect against international trade’s unique inherent risks, such as currency fluctuations, political instability, issues of non-payment, or the creditworthiness of one of the parties involved.

There are 2 main types of trade financing we do. Namely the Import and Export Financing.

IMPORT FINANCING

The Processes

1. Borrower will order goods from its supplier and issue a Purchase Order (PO)

2. With the PO, he will request for a trade line from the bank.

3. Once trade line is approved, the borrower’s bank will issue a Letter of Credit (LC) to the supplier’s bank.

4. Supplier’s Bank will advise and notify the LC to the Seller.

5. Seller will ship/deliver the goods to the buyer/borrower.

6. Upon delivery of the goods, the seller will present the shipping documents to their banks.

7. The supplier’s bank will send the shipping document & time draft to the borrower’s bank.

8. which will in turn be sent to the borrower for claim.

9. After that, the borrower’s bank will make the payment on behalf of borrower to the suppliers bank.

TYPES OF IMPORT FINANCING

1. Letter of Credit Issuance / Trust Receipt

- A Letter of Credit (LC) line allows you to use a credit line to purchase goods from your supplier. It is issued at your request to assure payment to your supplier up to a certain amount, within a prescribed time, depending on the LC line granted by the bank.

- A trust receipt is a notice of the release of merchandise to a buyer from a bank, with the bank retaining the ownership title of the released assets. In an arrangement involving a trust receipt, the bank remains the owner of the merchandise, but the buyer is allowed to hold the merchandise in trust for the bank.

- A LC facility together with TR credit terms is structured as a revolving business line of credit line for the user.

2. Inward Bill Collection (DA/DP)

The Bank will save time and collect your goods quickly with the Inward Bill Collection facilities. The banks will help process these documents and payments on your behalf. There are two ways the bills are being collected:

i. Documents against Acceptance (DA) The Bank will release the import documents to you upon acceptance of the bills of exchange/drafts; and you have an agreement to pay the seller a certain amount on a predetermined date.

ii. Documents against Payment (DP) The bank will release the import document to you upon your payment.

3. Shipping Guarantee

Shipping Guarantees are formal financial obligations or undertakings in favour of third parties, issued by banks on behalf of customers, to facilitate their business dealings

EXPORT FINANCING

The Processes

10. Borrower received a Purchase order from their customer to buy their goods.

11. They approached their bank to apply for an export financing facility and got a credit line. They received their payment earlier and it close their cashflow gap.

12. Their customer makes payment to the borrower at the end of the credit terms.

13. Borrower repay their bank on the due date.

TYPES OF EXPORT FINANCING

1. Export Letter of Credit

(LC) Advising

Bank will authenticate your LC so you can trade with peace of mind. A notification will be sent once the bank receive it.

2. Export LC Discounting

/Negotiation

Get a cash advance with your goods while negotiating an export Letter of Credit so you can quickly improve cash flow.

3. Export LC Confirmation

The bank will confirm your LC to help minimise uncertainty over the credit rating of your buyer’s bank or any in-country risks.

4. Export Documentary

Collection

The bank will present your export documents to the buyer’s bank upon payment or upon acceptance to pay at a future date.

5. Accounts Receivable

Financing

Accounts Receivable Financing is designed to improve your cash flow by unlocking up to 90% of your receivables.

4 BENEFITS OF HAVING A TRADE FACILITY

1. Help reduce the risk associated with global trade

Trade finance can help reduce the risk associated with global trade by reconciling the divergent needs of an exporter and importer. Ideally, an exporter would prefer the importer to pay upfront for an export shipment to avoid the risk that, the importer takes the shipment but refuses to pay for the goods. However, if the importer pays the exporter upfront, the exporter may accept the payment but refuse to ship the goods.

A common solution to this problem is for the importer’s bank to provide a letter of credit to the exporter's bank that provides for payment once the exporter presents documents that prove the shipment occurred, like a bill of lading. The letter of credit guarantees that once the issuing bank receives proof that the exporter shipped the goods and the terms of the agreement have been met, it will issue the payment to the exporter.

With the letter of credit, the buyer's bank will take on the responsibility of paying the seller. The buyer's bank would have to ensure the buyer was financially viable enough to honor the transaction. Trade finance helps both importers and exporters build trust in dealing with each other and thus facilitating trade. Trade finance allows both importers and exporters to access to many financial solutions that can be tailored to their situation, and sometimes, multiple products can be used to help ensure the transaction goes through smoothly.

2. Improves Cash Flow and Efficiency of Operations

Besides reducing the risk of non-payment and non-receipt of goods, trade finance has become an important tool for companies to improve their efficiency and boost revenue.

It is an extension of credit in many cases. Trade finance allows companies to receive a cash payment based on accounts receivables in case of factoring. A letter of credit might help the importer and exporter to enter a trade transaction and reduce the risk of non-payment or non receipt of goods. As a result, cash flow will be improved since the buyer's bank guarantees payment, and the importer knows the goods will be shipped.

In other words, trade finance ensures fewer delays in payments and allows both importers and exporters to run their businesses and plan their cash flow more efficiently.

3. Increased Revenue and Earnings

Trade finance allows companies to increase their business and revenue through trade. For example, a company that can clinch a sale for a large order, might not have the ability to produce the goods needed for the order.

However, through the help of trade financing from the banks, the exporter can complete the order by having the financial means to pay their suppliers.

As a result, the company gets new business that it might not have had, with the support that trade finance provides.

4. Reduce the Risk of Financial Hardship

Without trade financing, a company might fall behind on payments and lose a key customer or supplier that could have long-term impact for the company. Having options like revolving credit facilities and accounts receivables factoring can help companies on their cashflow and tie them through in times of financial difficulties.

TRADE LOANS - ENTERPRISE FINANCING SCHEME (EFS)

Without trade financing, a company might fall behind on payments and lose a key customer or supplier that could have long-term impact for the company. Having options like revolving credit facilities and accounts receivables factoring can help companies on their cashflow and tie them through in times of financial difficulties.

The Enterprise Financing Scheme – Trade Loan (EFS-TL) finances trade needs, including:

Inventory / Stock financing

Structured pre-delivery

working capital

(revolving working capital)

Factoring (with recourse) /

Bill of invoice /

AR discounting

EFS Trade Loan Eligibility:

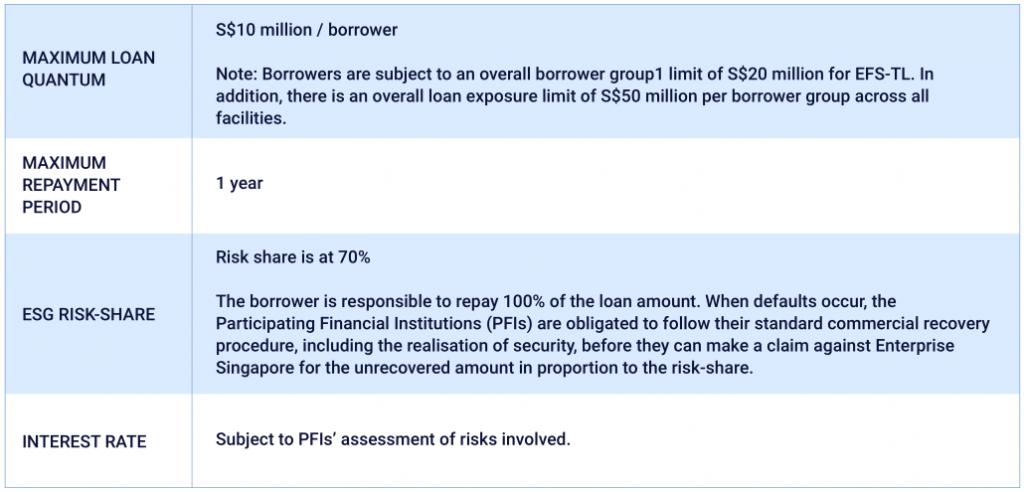

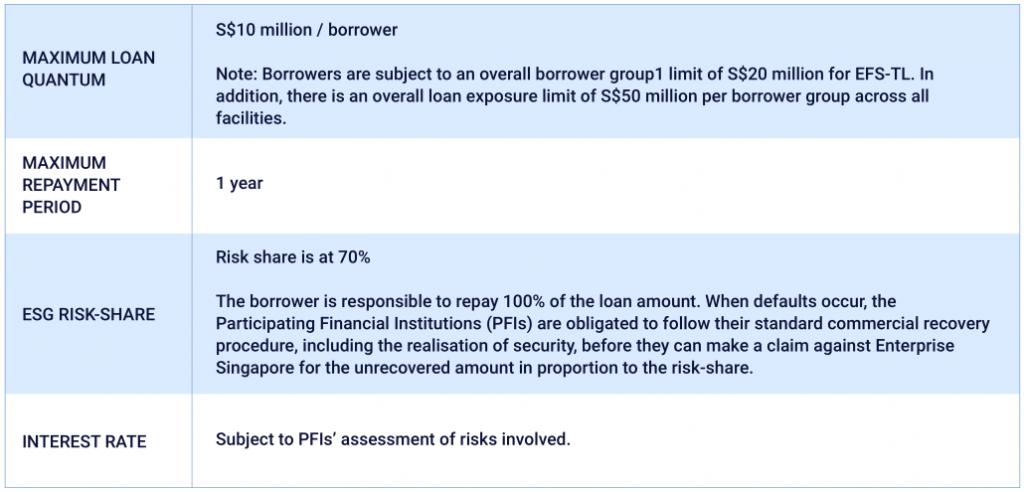

| Maximum Loan Quantum | S$10 million/borrower Note: Borrowers are subject to an overall borrower group limit of S$20 million for EFS-TL. In addition, there is an overall loan exposure limit of S$50 million per borrower group across all facilities. |

| Maximum Repayment | 1 year |

| EnterpriseSG Risk-share | - Risk share is at 50% - Young enterprises or enterprises operating in a challenged market may receive a risk share of 70% - Borrowes are responsible to repay 100% of the loan amount - When defaults occur, the participating Financial Institutions (FIs) are obligated to follow their standard commercial recovery procedure, including the realisation of security, before they can make a claim against EnterpriseSG for the unrecovered amount in proportion to the risk-share |

| Interest Rate | Subject to participating FIs' assessment of risks involved |

CLICK HERE TO CHECK IF YOU ARE ELIGIBLE FOR THE EFS TRADE LOAN

Our Support for Your Trade Financing Needs

With Bizsquare, you can access streamlined trade finance tailored to your operational profile. Whether you require LCs, factoring, or TR facilities, we work with partners that understand your industry and trade cycle. We help you:

- Assess the right trade finance instrument for your needs

- Structure ESG-qualified, government-subsidized or private trade loans

- Prepare and submit documentation accurately

- Expedite approval and disbursement efficiently

Take the Next Step Today

Don’t let cashflow gaps stall your trade plans. Whether you’re scaling imports, exports, or trading volumes, our tailored trade finance services equip you with the liquidity and flexibility needed to perform confidently.

Get expert guidance, optimized funding plans, and fast access to finance customized for your business goals.

TRADE FINANCING SINGAPORE FAQ

You can finance both import and export cycles—covering supplier payments, invoices, letters of credit, and shipping guarantees.

Exact timelines vary, but with proper documentation your business can access financing in as fast as days—not weeks.

Yes—many facilities qualify for subsidies through Enterprise Singapore and the Loan Insurance Scheme (LIS), which reduce risk and cost for SMEs.

Generally, businesses must be Singapore-registered, with ≥30% local ownership, and have annual group revenue of ≤S$100 million or ≤200 employees.